Wealth Cultivars

PRO Indicator Rage

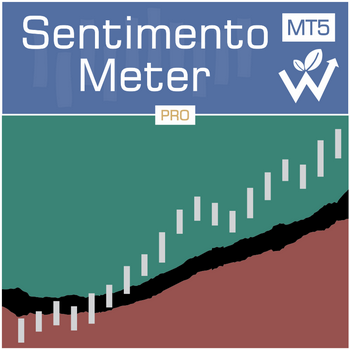

Sentimento Meter

Sentimento Meter is a world-class, first-of-its-kind price-based-market-sentiment-monitoring system that will warn you when the sentiment changes or when to stay out of the market when the sentiment is unclear.

Sentimento Meter has volatility based auto-adjusting DO-NO-TRADE zones, which keeps you safe and out of the market when an instrument is not safe to trade. Knowing when not to trade is as important to your profit as knowing in which direction to trade.

When the trend aligns with market sentiment, we see explosive moves. Don’t just trade with the long-term trend, trade in confluence with the greater overall market sentiment.

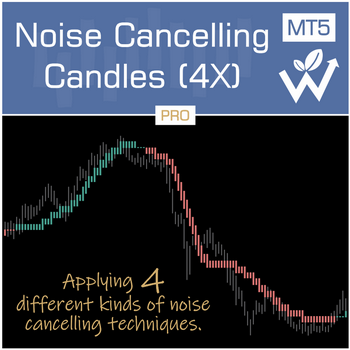

Noise Cancelling Candles

Noise Cancelling Candles filters out market noise and provides a clearer visual representation of the trend. The trend is easier to see for beginner traders. Experienced traders can stay in a trade while the market trend prevails, while still seeing classical chart patterns.

False signals and false retracements are minimized, giving you greater confidence in your price action analysis.

The analytical engine used in Noise Cancelling Candles includes our most powerful noise-cancelling engine to date, utilizing four different noise-cancelling principles and techniques.

The first component slows down the speed of the market, eliminating unnecessary false signals.

The second component helps smooth out price action by filtering out the noise from random short-term price fluctuations.

The third component is an allowable-random-price-movement-threshold. A new candle is created up or down from the previous candle only when the price moves beyond the current threshold.

The fourth component is used in determining the optimal allowable-random-price-movement-threshold value, based on a factor of the typical market volatility of the instrument and timeframe.

Our visual representation of the trend eliminates false signals and warns about likely trend reversals by displaying small body candles. This allows you to stay in the trade with confidence and helps minimize unnecessary trading activity.

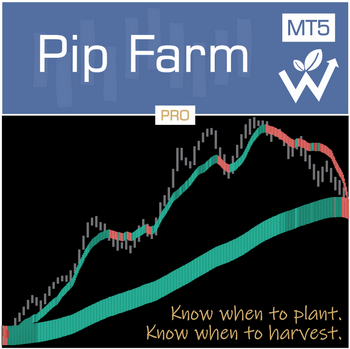

Pip Farm

Pip Farm is a best of breed trading system that enables you to profit multiple times from the same long-term-price-movement by identifying the medium-term-impulse-waves of the price move after a medium-term-corrective-wave.

It utilizes multiple noise cancelling techniques to identify the long-term trend and when a potential market reversal is probable it alerts the trader by darkening its colour.

Pip Farm accurately identifies the medium-term-impulse-waves while eliminating short-term-wave-noise using multiple noise cancelling techniques.

Knowing when to plant and harvest pips can increase your profit by up to 50% per trade.

Cyclelizer

A market cycle is the development of a bull market from the beginning until it matures and then reverses into a bear market, correcting the excesses from the bull market.

These cycles have been occurring from the start of market speculation. While no market cycle is identical, they usually demonstrate similar qualities during each phase, mainly due to human nature and market psychology.

During the discovery phase the last bear market ends and the new bull market trend starts. The Cyclelyzer turms from dark red to dark green. Without the Cyclelyzer this phase may only become apparent later in the cycle.

At the start of the momentum phase most market participants are sophisticated traders. By using the Cyclelyzer traders can identify this phase early on. The Cyclelyzer turns from dark green to light green. As awareness spreads excitement builds, creating strong momentum and accelerating the trend.

The blow-off phase is the most extreme phase of the bull market as the trend matures and more and more less-informed traders join the trend. Eventually the trend becomes unsustainable.

The transisition phase is the major turning point in market psychology. The sentiment moves from bullish to indecicive to bearish. There is still optimism that the trend may resume, but enough skepticism at this point to prevent it from happening. The Cyclelyzer helps to identify this phase by a darker green colour.

The deflation phase is really nothing more than the market reversing into a bear market. It typically happens quickly correcting the excesses built up during the bull market. The Cyclelyzer identifies the start of this phase by turning from dark green to red.

DISCLAIMER

Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

CFTC Rule 4.41 – Hypothetical or simulated performance results have certain limitations. Unlike an actual performance record, simulated results do not represent actual trading. Also, since the trades have not been executed, the results may have under-or-over compensated for the impact, if any, of certain market factors, such as lack of liquidity. Simulated trading programs in general are also subject to the fact that they are designed with the benefit of hindsight. No representation is being made that any account will or is likely to achieve profit or losses like those shown.

All information on this website or software is for educational purposes only and is not intended to provide financial advise. You accept full responsibilities for your actions, trades, profit or loss, and agree to hold the authors and any authorized distributors of this information harmless in any and all ways

(C) Copyright Wealth Cultiwars 2019 - 2022.

All rights strictly resrved.